Why Smart Money Moves to Gold and Silver in Times of Uncertaint

Share

The world’s economic compass is spinning. Inflation lingers above target, debt piles ever higher, and geopolitical flashpoints seem to multiply overnight. In the middle of this storm, seasoned investors are rushing toward hard assets. As Robert Kiyosaki reminds his readers, “Gold is God’s money.” That simple idea—owning something governments cannot print—has rarely felt more relevant than it does in 2025.

Spot gold hit a record high above $3,170 per ounce in April before easing to about $3,278 on May 12, still 23 percent higher year-to-date. Analysts now see an annual average above $3,000 for the first time ever, citing relentless central-bank demand and a weaker dollar. Even a brief 1 percent dip on upbeat U.S.–China trade headlines couldn’t dent the bigger trend: investors keep buying any pullback, treating gold as the ultimate portfolio insurance.

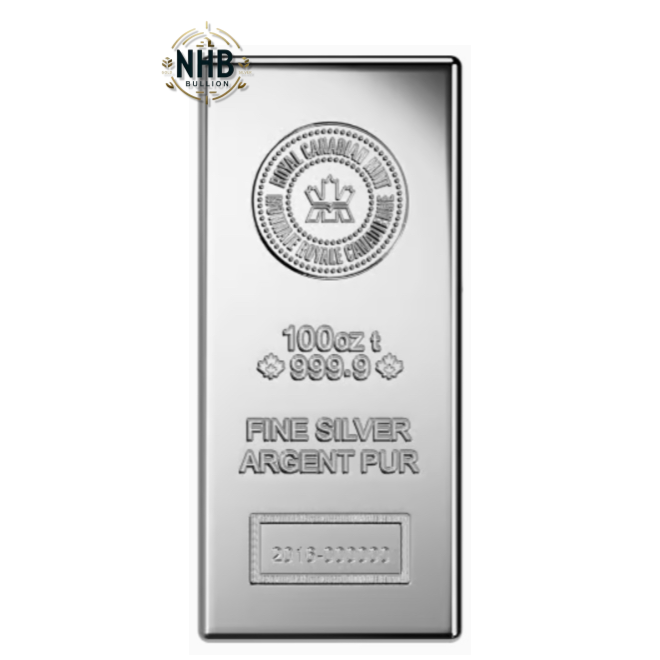

Silver is riding the same tailwind. Prices have climbed 10 percent in 2025 to roughly $33 per ounce. With the gold-to-silver ratio near 100, silver looks historically cheap, and its industrial heartbeat grows louder every quarter. Solar panels, EV charging infrastructure, and AI-driven electronics all consume ever more silver, turning it into a rare hybrid: both monetary metal and critical technology ingredient. Forecasters expect a deep supply deficit this year as mine output lags green-tech demand.

Behind the price action lies a powerful buyer nobody ignores—central banks. They snapped up 244 tonnes in Q1 2025, their eleventh straight quarter of net purchases. The National Bank of Poland led the charge, but a widening roster of emerging-market banks is diversifying away from the dollar. Their logic mirrors that of legendary money manager Peter Schiff, who often notes that “gold isn’t a commodity—it’s money.” When the institutions that print currency hoard bullion, everyday investors take notice.

Macro forces reinforce the case. Global debt has breached $315 trillion, while real policy rates sit barely positive. Every uptick in consumer prices chips away at cash savings, yet gold’s finite supply and silver’s exploding industrial roleform a double-barreled hedge. Unlike stocks or bonds, bullion carries no counterparty risk; its value isn’t tied to corporate earnings or government promises.

For individual savers, buying physical coins or bars offers three key advantages. First, it’s tangible—wealth you can literally hold. Second, it’s liquid, tradable in nearly every country and currency. Third, it’s private, sheltered from the cybersecurity threats that hover over digital assets. Add a modest allocation of gold and silver to a diversified portfolio, and you create a ballast that steadies the ship when markets pitch and roll.

Smart money understands one more truth: timing perfection is impossible, but time in hard assets beats timing paper trades. Whether you acquire a single one-ounce coin or build a larger stack, each piece of bullion converts vulnerable cash into a proven store of value. In an era where headlines change faster than algorithms can trade them, that quiet certainty is priceless.

Note: This content is for informational purposes only and does not constitute financial advice. Always perform your own due diligence or consult a qualified advisor before making investment decisions.

Note: All prices mentioned are in U.S. dollars (USD).