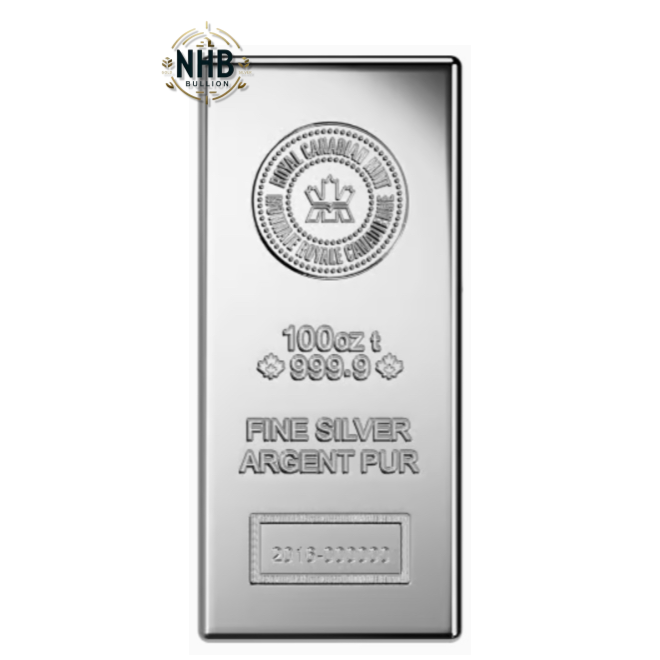

Canadian Maple Leaf Collection: Royal Canadian Mint Excellence

The Maple Leaf collection, minted by the Royal Canadian Mint, melds classic artistry with contemporary minting quality, offering valuable and dependable pieces that represent Canada's numismatic heritage.

Simplified Investing: Key Insights for Precious Metals

-

Private vs Government Mint

Learn the pros and cons of different sources for your metals. Government mints offer widely recognized coins, while private mints might present cost-effective options with unique designs.

-

Understanding Premiums

Beyond the spot price of metal, premiums cover minting, distribution, and dealer markup. We'll help you understand how to spot fair premiums to ensure you're investing wisely.

-

Choosing Your Metals

From collectible coins to bullion bars, choosing the right form of metal depends on your investment goals. We provide insights into liquidity, resale value, and how to balance your portfolio.

-

Investment Size

How much should you invest in precious metals? We offer guidelines based on your financial goals and risk tolerance, ensuring your investments align with your broader financial strategy.

Why Choose Bullion for Lower Premiums?

Precious metals like gold and silver have been revered throughout history not just for their beauty, but for their role in preserving wealth across generations. They offer a hedge against inflation, serve as a safe haven in times of economic uncertainty, and provide a diversification option that can mitigate risk in your investment portfolio.

Inflation Hedge

As currencies fluctuate, precious metals historically retain value. Their supply is finite, making them a robust store of wealth as the cost of living increases.

Wealth Preservation

From ancient empires to modern markets, precious metals have demonstrated remarkable resilience and growth. An ounce of gold could purchase a fine suit in Roman times, just as it can today.

Portfolio Diversification

Adding precious metals to your investment mix can reduce volatility. Unlike stocks and bonds, they typically move independently of financial markets, offering a buffer during downturns.

CONTACT US TODAY

Subscribe to our emails

Be the first to know about new collections and exclusive offers.