Silver Breaks $36: Industrial Might and Safe-Haven Demand Drive Rally

Share

Market Snapshot

Silver has climbed to $36.50/oz, its highest level since 2012, marking a ~26–27% YTD gain .

Dual Demand Drivers

Safe-haven demand has accelerated as gold touched record highs, prompting overflow interest into silver from investors seeking relative value . Meanwhile, industrial usage—from solar panels to electronics and EV batteries—has surged. The Silver Institute notes that over 54% of silver demand is industrial, a structural component that gold lacks .

ETF Inflows & Market Deficits

Silver-backed ETFs recorded inflows exceeding 300 tonnes in June alone, dwarfing inflows into gold ETFs . This surge in investment capital comes against a backdrop of five consecutive years of structural supply deficits, tightening physical availability .

Ratio Play & Valuation Angle

The gold-to-silver ratio now sits between 93 and 97, far above the long-term average of ~65–80, implying that silver remains undervalued relative to gold . Historically, such disconnects mark the onset of sharp silver catch-up rallies.

Technical Setup & Price Targets

Silver broke out past $35–$36 —signaling strong bullish momentum—while technical indicators (RSI, momentum) suggest further upside . Analysts are eyeing $40/oz, with bull scenarios extending toward $42/oz into 2026 . A sustained move above $38/oz could accelerate the trend further.

Regional & Currency Influences

A softer U.S. dollar—triggered by dovish Federal Reserve expectations—has enhanced silver’s global appeal . At the same time, currencies like the Indian rupee recently hit record silver prices (~Rs 1.06 lakh/kg), indicating robust local demand .

Supply-Side Constraints

Silver mining is supply-constrained because 70% of production is a byproduct of base-metal mining and remains unresponsive to spot price increases . Supply deficits are expected to persist through 2025, underpinning the upside .

Portfolio Positioning

For tactical gains, a pullback to $36/oz could serve as a re-entry point, targeting $38–$40 in the medium term. For strategic exposure, silver offers a hybrid hedge—tapping both inflation protection and industrial growth. However, volatility is higher than gold—position sizing and stop-loss discipline are advised.

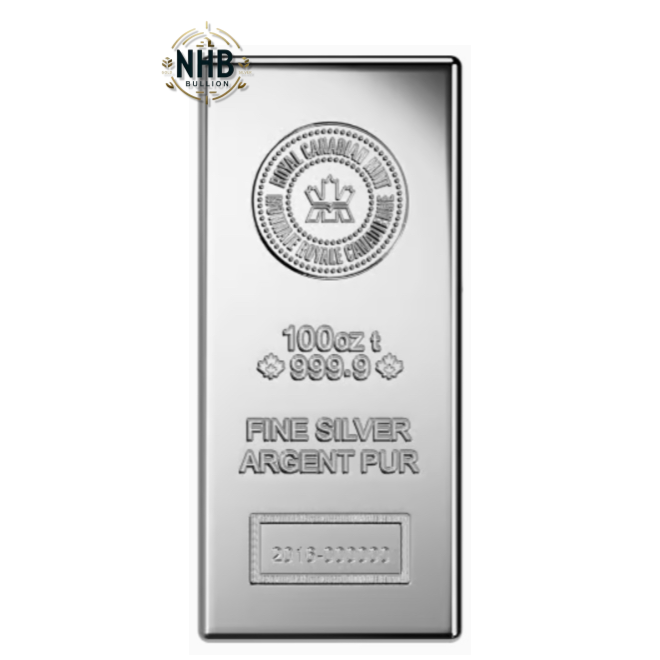

NHB Bullion Advantage

Our live silver pricing API delivers every tick so you can track critical technical levels like $35, $36, and $38 in real time. Combined with NHB Bullion’s market alerts and alerts, you stay ahead of fast-moving trade setups.

Outlook & Watch Points

Watch U.S. inflation and Fed commentary for impact on the dollar and yield curve. Industrial demand updates—especially solar manufacturing and tech production—can drive new inflows. Monitor gold prices and ratio shifts for clues on silver’s next leg.

Disclaimer

This content is provided for informational purposes only and does not constitute financial, legal, or investment advice. All prices are quoted in U.S. dollars (USD) based on data available at the time of writing. Please seek professional guidance before making investment decisions.